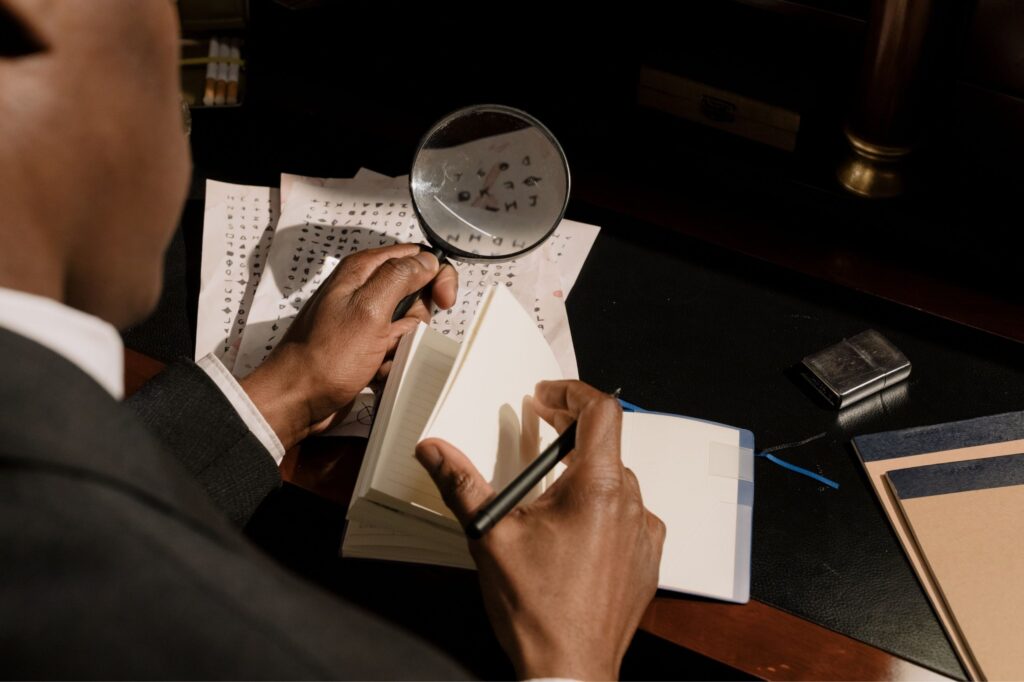

INVESTIGATION SERVICES

Dedicated Investigation services

What We do

Request A Quote

In today’s business world, it’s essential to have an effective investigation service by an accounting firm if you want to stay ahead of the competition. Accounting firms rely on skilled investigators to help them probe into the backgrounds of potential clients and businesses in order to determine whether they are a good fit for their services. By using investigative software, accounting firms can speed up the process of conducting investigations, making sure that they remain competitive in the market.

Types of investigation services

There are many types of investigation services available to accounting firms. Some common services include:

- Audit monitoring: This service helps accountants keep tabs on their audits to ensure that they are being conducted in an accurate and timely manner.

- Internal investigations: This type of investigation can be used to probe into possible wrongdoing by employees or other members of the firm.

- Forensic investigations: This type of investigation is typically used to investigate financial crimes, such as fraud or embezzlement.

What is the Accounting Investigation Service?

The Accounting Investigation Service is a service offered by accounting firms to their clients. The service allows clients to have their tax returns and other financial statements audited by the accounting firm. This service is beneficial to both the client and the accounting firm. The client can have confidence in the accuracy of their financial statements, and the accounting firm can ensure that they are providing accurate and up-to-date information to their clients.

How does the service work?

The investigation service by an accounting firm works by providing a team of experienced professionals who will work with you to help resolve any tax issues that may be affecting your return. The team will consult with you to understand your situation and provide recommendations on how to best address the problem. They will also provide support throughout the process, ensuring that everything is done in a timely and efficient manner.

The Process of an Accounting Investigation

When a business has questions about the accuracy of its accounting records, it can turn to an accounting firm for help. An accounting investigation is a process that an accounting firm will use to determine the accuracy of a company’s financial statements. The process begins with gathering information from the company and its employees. The accounting firm then conducts research into the company’s past financial reports and makes comparisons to current data. If there are any discrepancies, the accounting firm will investigate them further to determine their source. Finally, the accounting firm will provide a report detailing its findings and recommendations.

What are some common findings in an investigation?

An accounting firm is hired to investigate a company. What are some common findings in an investigation?

- The company may have committed fraud.

2. The company may have overstated its profits.

3. The company may have understated its expenses.

4. The company may have falsified documents.